Taxes Based On Payment Method

In response to regional taxation requirements, our platform now dynamically adjusts taxes based on the chosen payment method. This ensures compliance with tax regulations and provides a seamless experience for both administrators and users. For example, in regions like Pakistan, where Value Added Tax (VAT) rates may vary depending on the payment mode Online payments incur a 5% VAT, while cash payments incur a 15% VAT, administrators can now effortlessly manage tax rates for each scenario. This enhancement ensures compliance with regional tax regulations while providing administrators with greater flexibility and control over their taxation strategy.

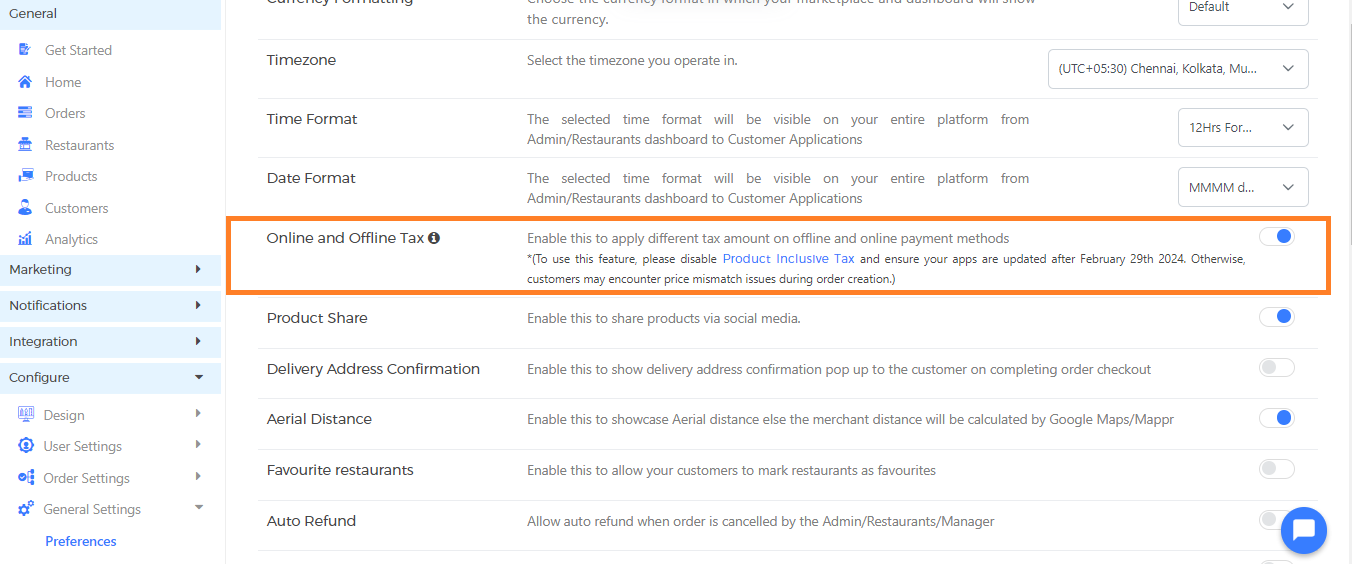

Configuration Enablement:

Admins can activate this feature from the dashboard by navigating to:

Configure > Preferences > Online Offline Tax toggle.

However, please note that this feature is not compatible with the “Product Inclusive Tax feature”.

Users can only enable one feature at a time.

Fig1: Configuration Enablement

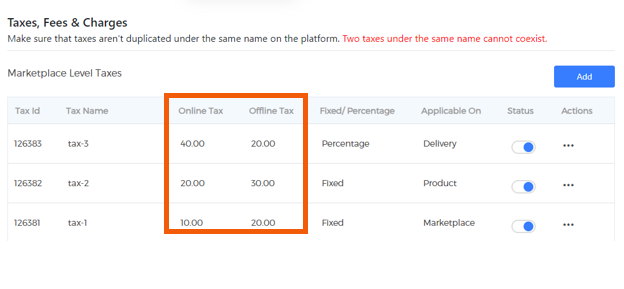

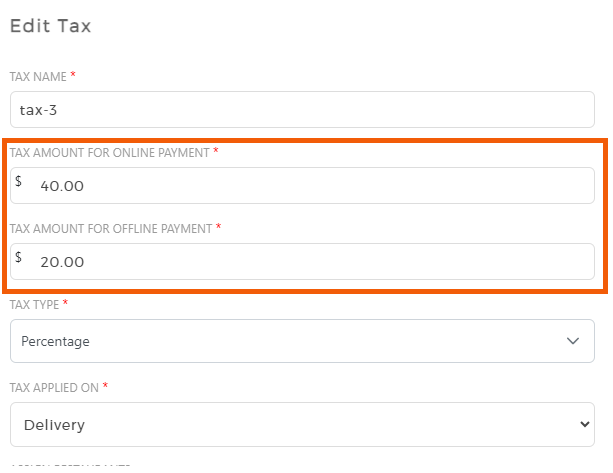

Customizing Tax Values for Online and Offline Payments:

If the user enables the toggle for online and offline tax, existing taxes with offline payment values will automatically mirror online payments unless otherwise specified.

Admins can set values for both modes when adding or editing taxes under Configure > Order Settings > Tax, Fees, and Charges.

Fig2: Tax Visibility Post-Configuration

Fig3: Tax Configuration – Online / Offline

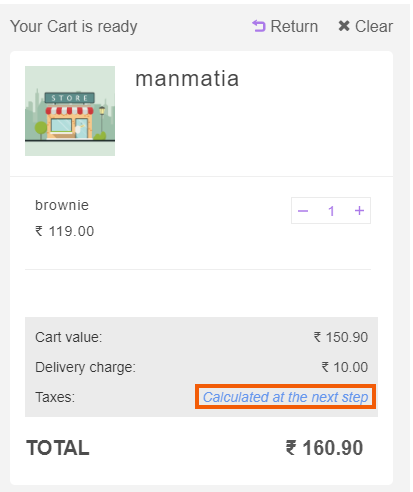

Customer Experience on Checkout:

At the checkout page, taxes will not be displayed if this feature is enabled. Instead, the text ‘Taxes will be calculated at the next step‘ will be shown in the taxes section, as the customer selects the payment method on the subsequent screen. If the feature is disabled, taxes will be shown on the checkout page.

Fig4: Checkout Screen Tax Visibility

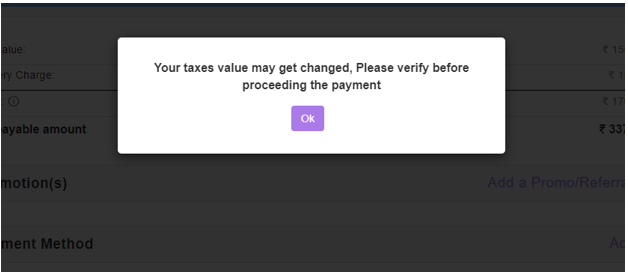

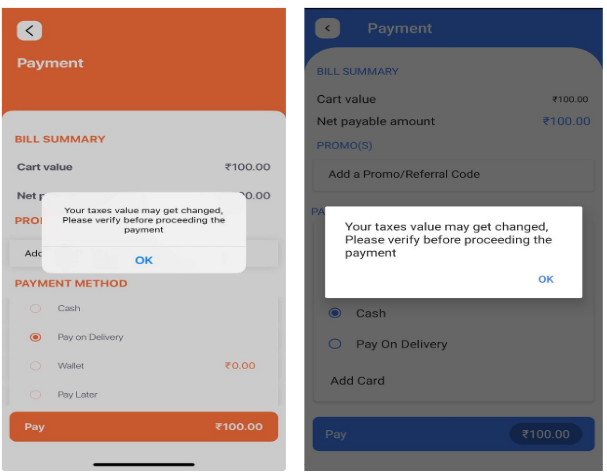

Customer experience on the Payment page:

Both the Customer Web App and native customer applications will now display taxes based on the selected payment method. If the customer decides to change the payment method on the payment screen, a prompt will appear, notifying them of the tax adjustment. The message will read: “Your tax value may get changed, Please verify before proceeding with the payment.” Subsequently, the tax value will be updated and will be reflected as per the payment method chosen.

Fig5: Tax Handling with Payment Gateway Integration (web)

Fig6:Tax Handling with Payment Gateway Integration (native apps)

“Pay Later” and “Pay On Delivery” payment methods:

We currently offer both “Pay on Delivery” and “Pay Later” options for both online and offline transactions, with offline tax set as the default. However, users need to create a ticket to request modifications from the team to assign these payment methods to either the Online or Offline Tax category.

Leave A Comment?